What Does It Take to Win on the Digital Shelf With CVS and Sephora?

In beauty and personal care sales, loyalty goes both ways. A majority of beauty shoppers are loyal to brands they know. According to a 2019 report from market research firm Ipsos, 41% say they wouldn't buy a personal care product they haven't tried in person.

In turn, retailers like CVS and Sephora have invested heavily in loyalty programs and personalization across their digital and brick-and-mortar outlets. For both new and established brands, success lies in providing the right amount of detailed product information to each retailer. This information empowers brands to send customized messages that resonate with the relevant buyer segments.

Beauty Brands Have Complete Control of the Digital Shelf

The opportunity: Personal care brands can control precisely how products are displayed on the digital shelf — everywhere the products appear. Brands must deliver the right product information, images, and other digital assets in the right context to influence the next sale.

But delivering channel-specific content at the speed and scale required isn't easy.

Each retailer or distributor has different requirements and methods of data collection. These retailer requirements frequently change across product categories as retailers optimize and differentiate shopping experiences.

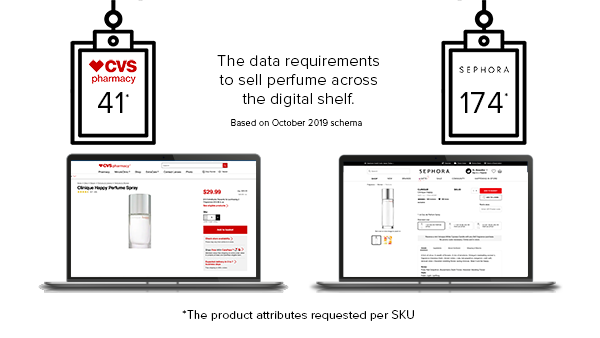

On Sephora and CVS, for example, item set up requirements for a bottle of perfume differ.

Syndication: The Right Content for the Right Place

At its simplest, syndication is about sending the right content to the right place. Sending data from Point A to Point B should be an open, transparent, and low-cost process.

Syndication can’t begin or end with mere data delivery to grow product sales. Brands need the ability to customize content for every channel while ensuring a consistent brand experience. They also need the ability to refine this experience to drive discovery.

This process requires an integrated system that lets brands store and manage channel-ready versions of product information. One that allows brands to adjust data for one channel — or across the core data set — dependent on need. One that will enable brands to validate data against these requirements so they can deliver the best content for every channel.

Written by: Cara Wood

Cara Wood (she/her) is a writer and former director of brand journalism at Salsify, where she specialized in creating content to help brands excel in ecommerce. Her work has helped organizations enhance their digital shelf and product experience management strategies.

Recent Posts

How Brands Can Use Digital Product Passports To Promote Sustainable Commerce and Build Consumer Trust

7 Excellent Product Description Writing Examples

How the Pantone Color of the Year Affects Brand Strategy

Subscribe to the Below the Fold Newsletter

Standing out on the digital shelf starts with access to the latest industry content. Subscribe to Below the Fold, our monthly content newsletter, and join other commerce leaders.

.svg)