The Complete Guide to Omnichannel Strategy for Commerce

Download our guide to discover how to build engaging, omnichannel shopping experiences to meet shopper demands.

DOWNLOAD GUIDEPIM

Manage all product content in one central system of record.

Syndication

Easily syndicate product content to every consumer touch point.

Enhanced Content

Enrich product pages with below-the-fold content and rich media.

Intelligence Suite

Bring AI-powered capabilities directly into your Salsify workflows.

Grocery Accelerator

Leverage the first-ever category-wide PXM accelerator in the grocery industry.

GDSN Data Pool

Synchronize standard supply chain, marketing, and ecommerce attributes globally.

Digital Shelf Analytics

Continuously optimize your organization’s product content syndication.

Catalog Sites

Share secure, on-brand, and always up-to-date digital product catalogs.

Automation and AI

Automate business processes and enhance Salsify workflows with AI.

PXM Platform, Integrations, and APIs

Integrate the PXM platform with the rest of your enterprise systems architecture.

Supplier Onboarding

Accelerate supplier onboarding while ensuring your schema requirements are met.

Product Listing

Sell products faster with Product Listing.

Content Enrichment

Increase online conversions with Content Enrichment.

Automation

Save time and increase operational efficiency with retail automation.

SXM Platform, Integrations, and APIs

Integrate the SXM platform with the rest of your enterprise systems architecture.

Syndication Network

Automate how you exchange product content data to the digital shelf.

Enhanced Content Network

Turn product pages into product experiences with Enhanced Content.

Commerce Platform Integrations

Create winning product experiences everywhere shoppers are, including on owned sites.

GDSN Data Pool

Synchronize standard supply chain, marketing, and ecommerce attributes globally.

Open Catalog

Connect to the digital shelf faster with an open, standardized, and free product catalog.

Resources

Resource Library

Explore our ecommerce resources to get everything you need to win on the digital shelf.

Blog

Read our blog to get actionable insights for navigating changing markets and industry demands.

Webinars

Watch our on-demand ecommerce webinars to gain expert advice and tips from our community of industry leaders.

Customer Blog

Gain the latest tips, industry trends, and actionable ecommerce insights.

Knowledge Base

Investigate our knowledge base to build your Salsify skills and understanding.

API

Examine our comprehensive API and webhook guides to start working with Salsify quickly.

Download the report to get expert insights, consumer research, and top industry trends.

Fledgling, direct-to-consumer (D2C) startups have recently disrupted some beauty brands with generations-long legacies. Select store brands have also unseated trendy, high-end manufacturers in consumer popularity. Rapid and unpredictable change is the new norm for the market — all thanks to digital transformation.

The way shoppers learn about brands, research products, compare options, and make purchases often happens with little-to-no face-to-face interaction. A buyer may never even step foot in a store in some cases.

As more of the buying journey happens online, it’s easy for brands to feel like it’s out of their control. But brands have more power than they may realize, as activating content can help brands across industries win on the digital shelf.

Leading brands utilize activation, which helps brands unify in-store and online workflows, create engaging product experiences, and connect with their entire commerce ecosystem. But retailers want unique online experiences, leading to continually shifting requirements and time-consuming processes for optimizing product content.

Implementing a product content syndication solution can help beauty brands not only move content but also ensure they can keep up with these changes. Successful content activation includes everything from images, video, comparison charts, and other critical product information. From the descriptions brands share to the quality of their product photos, successful brands maintain a cohesive brand identity customized to every retailer audience.

Here are five examples of brands that are activating product content in a way that engages every audience while maintaining brand consistency across the digital shelf.

Just because a brand has become a household name doesn’t excuse them from providing detailed product descriptions and rich media to assist shoppers in the decision-making process. Personal care brand Q-tips understands this fact.

The popular cotton swab, manufactured by Unilever, offers consumers a wide variety of uses — all of which are explained in their detail-rich product pages. The brand acknowledges its most common and well-known use as a personal care tool, as well as its applications for creativity and crafts, cleaning electronics and jewelry, baby and pet care, and more.

Q-tips also recognize that, when consumers are shopping for daily hygiene products, they want something familiar and reliable. Its images clearly depict the product and give an idea of its relative size for those who may not have purchased Q-tips before.

Image Source: Q-tips Amazon

When a shopper compares facial treatments, cleaners, or supplements, he or she is usually looking for two key pieces of information: What’s in the product? How will it fit into his or her daily routine? TruSkin Naturals, a skincare line that specializes in serums, cleansers, moisturizers, and toners, takes care to acknowledge these concerns upfront.

As one of many skincare lines available today, TruSkin Naturals recognizes the importance of standing out, capturing shoppers’ attention, and giving them everything they need to make an immediate purchase decision.

On Amazon, the brand starts by providing above-the-fold bullets describing how and why customers use the product, primary ingredients, its cruelty-free status, and its manufacturer guarantee. By answering the most frequently asked questions up front — and encouraging reviews — the brand brings buyers closer to converting.

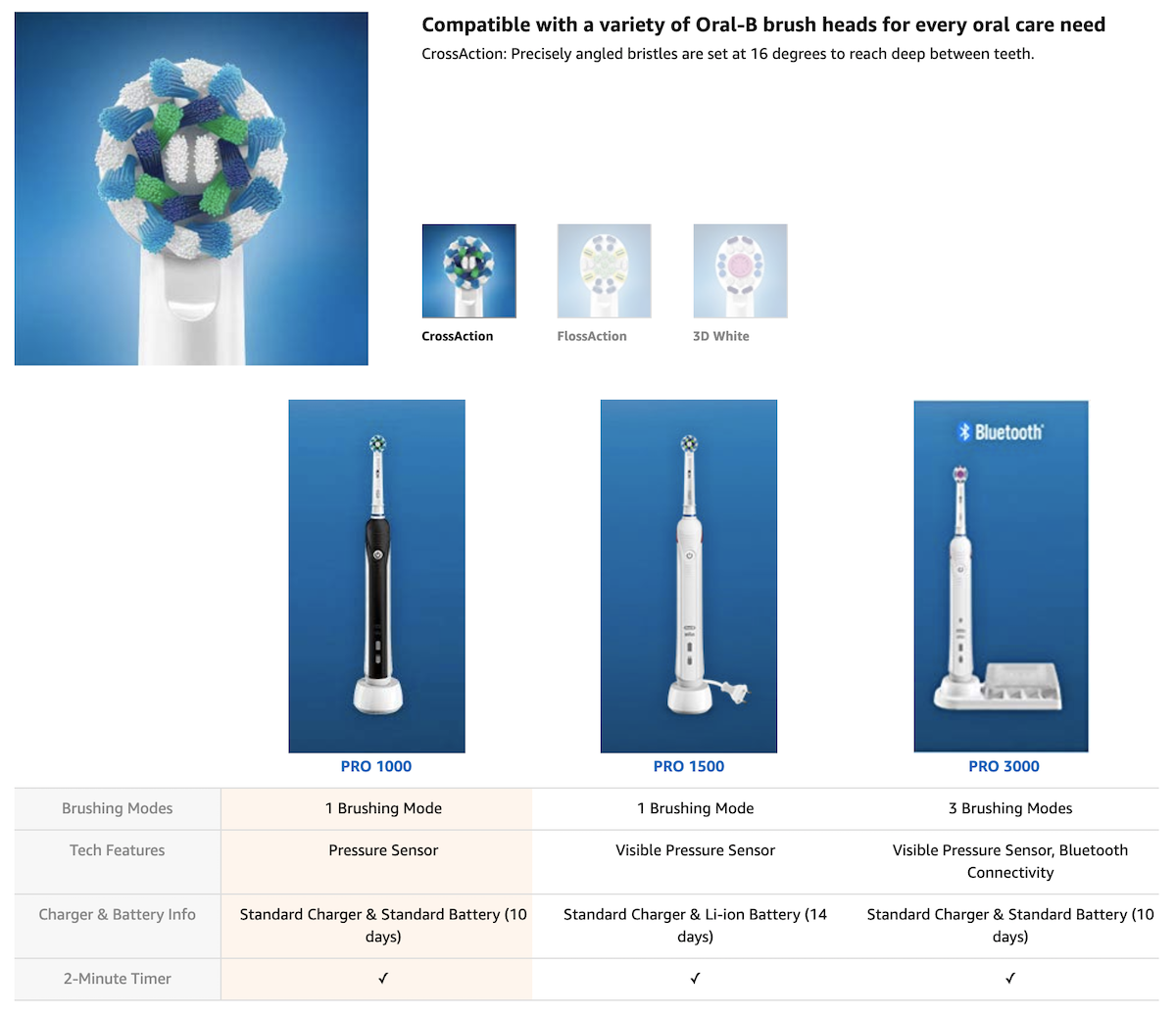

Dental hygiene is an essential part of personal care routines, and electric toothbrushes make it easy and effective. But because this is a more significant investment than a standard disposable toothbrush, consumers often compare multiple options before completing a purchase.

Oral-B took these consumer habits into account when activating product content for its “Oral-B White Pro 1000” rechargeable electric toothbrush. In addition to providing critical facts via bulleted descriptions, the brand made use of the product page real estate unique to each retailer.

The brand used the allotted manufacturer space on Amazon’s product page to share eye-catching images, straightforward product details, and side-by-side comparisons with other models. To beat out different brands, Oral-B doubled the image count of its competitors and encouraged verified buyers to leave reviews.

Image Source: Oral-B Amazon

There’s a reason the haircare section of most drugstores and cosmetic stores is one of the biggest: There are countless combinations of hair types, textures, and needs to meet. People often spend a great deal of time searching for a product that solves their unique hair challenges, especially when looking to overcome hair loss.

Ultrax Labs manufactures a hair-growth-stimulating shampoo, conditioner, and supplement made with caffeine — which it says helps reduce hair loss and stimulate growth by blocking testosterone within the skin.

To set the brand apart from other hair growth treatments, Ultrax Labs starts by leveraging the product title field to communicate its claim. The brand then used the Amazon product page’s manufacturer space to address common questions and delve deeper into the science behind its active ingredients.

Asking customers for feedback also earned the brand 7,700-plus reviews on Amazon, including several convincing before-and-after images.

When shoppers spend $100 or more on grooming equipment, they’re seeking high quality, high value, and a brand they can trust. Braun, a nearly 100-year-old German manufacturer of consumer products, has a legacy of developing reliable technology. But, just as with Q-tips, it takes more than a well-known name to set a brand apart online.

Instead of creating a large volume of product information, the brand focused its attention on highlighting only essential, core features. It then allowed its aesthetically pleasing imagery, captivating videos, and customer reviews to tell the rest of the story.

Doing this freed up product page real estate on retailers like Amazon, Target, and Bed Bath & Beyond for more extensive comparison charts and details about brand values.

Image Source: Braun Amazon

It’s increasingly critical for brands to keep product content consistent. Whether a shopper uses Amazon, Walmart, CVS, Walgreens, Costco, Target, or another retailer, they should enjoy the same high-quality and memorable brand experience across the digital shelf.

Download our guide to discover how to build engaging, omnichannel shopping experiences to meet shopper demands.

DOWNLOAD GUIDEStanding out on the digital shelf starts with access to the latest industry content. Subscribe to Below the Fold, our monthly content newsletter, and join other commerce leaders.