3 Steps to Using Product Categories to Drive Multi-Channel Sales

Written By: David Gold

Hearing cranky men banter is amusing. But their lack of concern for the difference between two types of bread made me think - who does care about the details of the bread they buy? Consumers only care about the product details that matter to them, and what matters to each person is different. The second man in the conversation couldn't care less about how bread is processed, but there are people who will only make purchase decisions when detailed information about ingredients and processing is available. Today, marketers and merchandisers are faced with meeting the demands of the different types of buying personas. I went to a diner early the other morning and happened to overhear a conversation behind me. Two senior citizens were chatting about Florida when the waitress interrupted them to take their order. The subject of toast came up, and one gentleman said to the other, "There's whole wheat toast then there's whole grain toast. Is there a distinction?" His friend stood silent, so he probed, "What's the difference? You ever think about that?" His friend calmly replied, "No. In all my years, I have never thought about that, and I can promise you I don't intend to start now."

To help solve this, retailers are focusing on delivering the personalized customer experience that consumers want. And consumers want a more robust set of information to help them make the right decision. Obvious, but this means the need for a rich set of product content is only going to become more urgent, and the complexities of organizing the data in unique ways will grow with the demand.

One of the core areas of focus for retailers is building a faceted search experience that makes it easy for shoppers to find the products they're looking for. To effectively do this, retailers need a unique set of product categories and attributes for each product they sell. Categories are set by the retailers, but it’s up to the brands to determine where a product should be listed. For brands, failing to include a category or attribute when listing a product means it won't get listed in a search, won't get found, and won't get purchased. The Customer might not get the best product for their needs, and brands and retailers lose revenue.

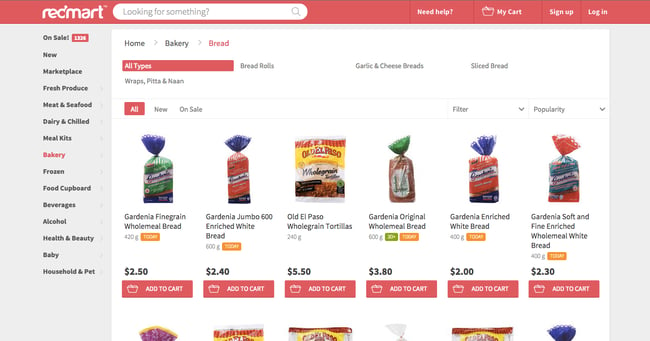

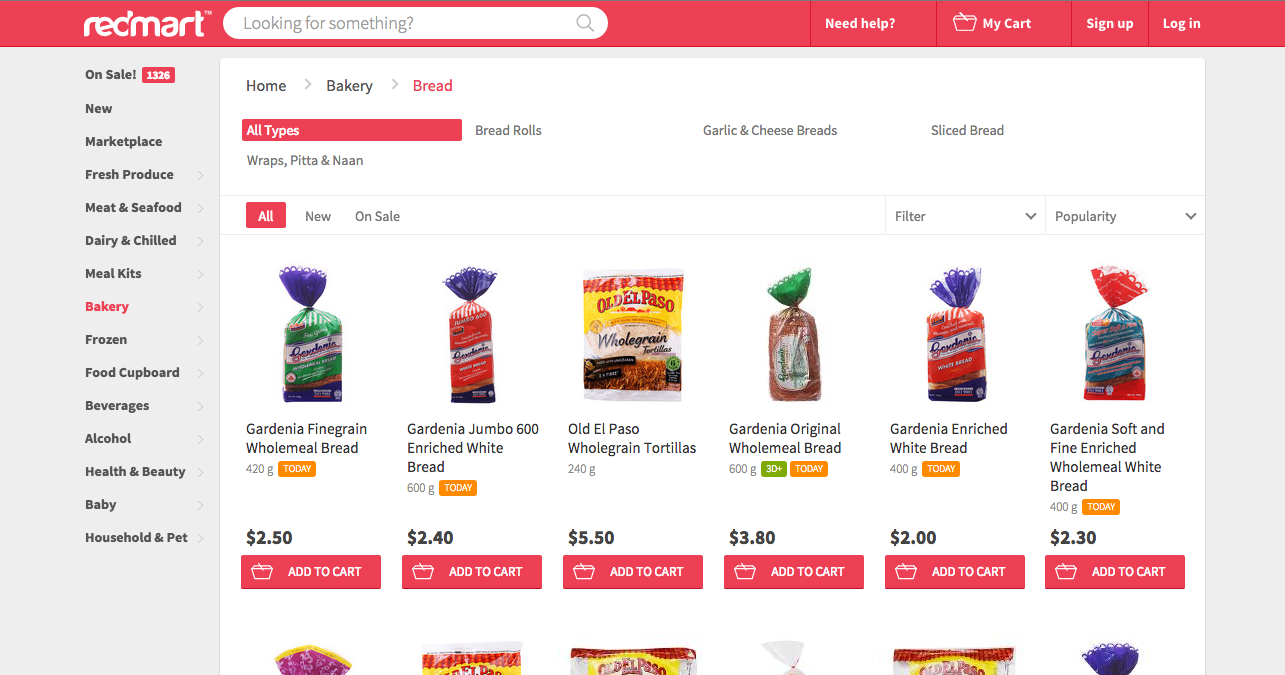

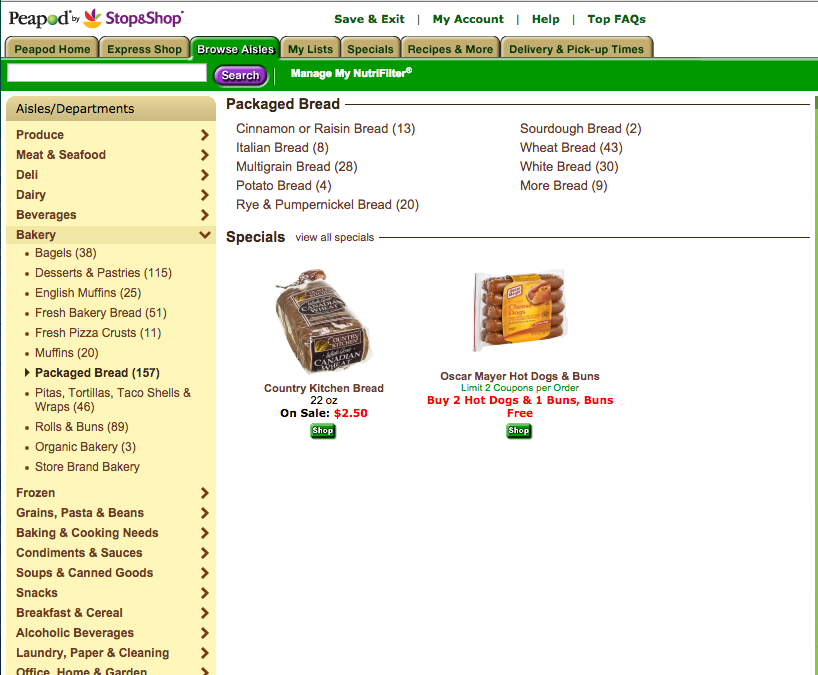

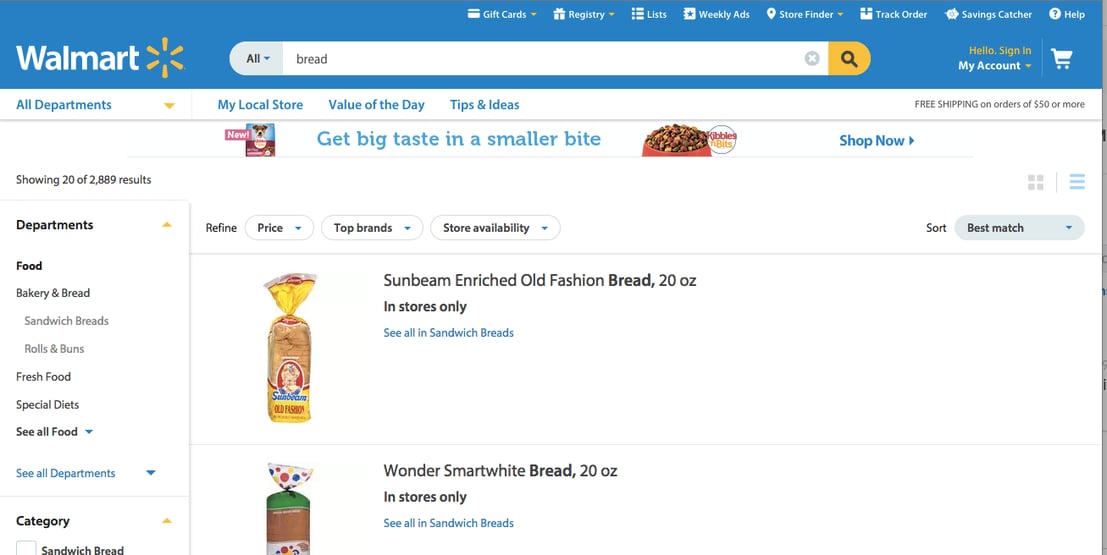

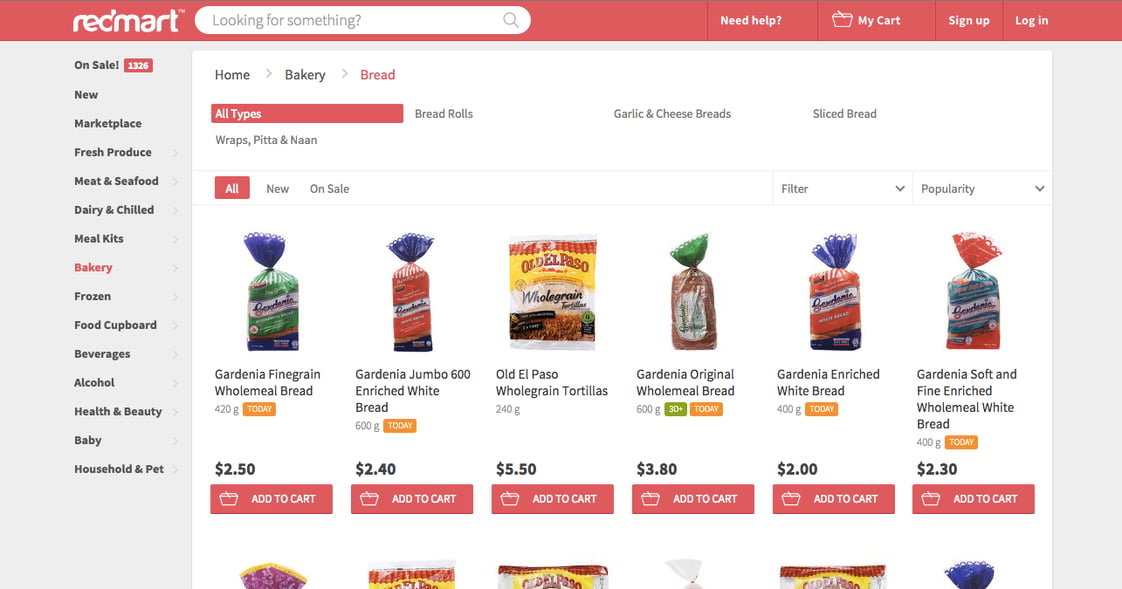

Each retailer's product categories are unique, likely determined by their customers persona, search behaviors, and yes, margins. I took a look at bread to see how different retailers are shaping the landscape:

Peapod matches product categories to the in-store experience. When you drill down, they list products alphabetically.

Redmart has yet another way to categorize bread. They have sliced, which is similar to sandwich bread, but also have other categories.

At first glance, it seems simple for brands to choose the product type for each retailer. But when you take each retailer's unique product category requirements and multiply it by the hundreds or thousands of products each brand has, the challenge becomes overwhelming.

I talk to brands that are up against this every day (the categories go far beyond grocery). Here are some simple steps others are taking to navigate the complexities of the evolving retail market:

1. Focus on your top 5. Identify your top 5 retail channels (you probably already know them). Spend some time on each site, look at how they are merchandising your product categories. Are your products listed in the right places? If not, take note of the places where you should be, but aren't. Revisit your item setup sheets, update your content and resubmit.

2. Rinse and repeat. Multichannel commerce experiences evolve daily - and so does the content each retailer is requesting. Keeping your top 5 in mind, check for new item setup forms and resubmit content to meet new requirements. As you know, merchandising needs to happen throughout the life of the product, not just at the point of onboarding.

3. Track your results. How many categories was your product listed under before you made changes? And after? Are your products listed in the top search results before you improved the content? And after? Create a simple tracking sheet (test for categories, keywords and related products) to see how your products are placing before and after changes. It will help you and your company understand the impact of the changes you’re making.

Let me know if you've tried something else to help manage some of these complex content challenges - the advice is helpful for everyone. And, of course, if you'd like to see how Salsify can help, let me know that, too.

Written by: David Gold

David spends his days (and nights) talking to brands in the ecommerce space about some of the product content challenges and opportunities they're facing. He joined the Salsify blog to share his learnings and insights on the nitty gritty of what's happening, what's working and what isn't.

Recent Posts

What the Data Says About Consumer Interest in AI Shopping Agents

How Retailers Can Use Geolocation To Create Personalized Shopping Experiences

3 Examples of a Personalized Shopping Experience and How To Create Them

Subscribe to the Below the Fold Newsletter

Standing out on the digital shelf starts with access to the latest industry content. Subscribe to Below the Fold, our monthly content newsletter, and join other commerce leaders.

.svg)