How to Optimize Toy and Game Pages on Amazon | Salsify

The demise of Toys R Us in mid-2018 presented a major opportunity for other retailers to capture a portion of the defunct chain’s $11.5 billion in annual toy sales. For toy brands, it also meant that other large national retailers, including Amazon and Walmart, would become even more important sales channels in order to recoup lost Toys R Us revenue. Toy consumers have quickly shifted a lot of their spending to these already well-known retailers. According to Retail Dive, Amazon reported a 30% year-over-year increase in toy sales during the latter portion of 2018, and Walmart has similarly seen its toy sales help drive overall revenue increases.

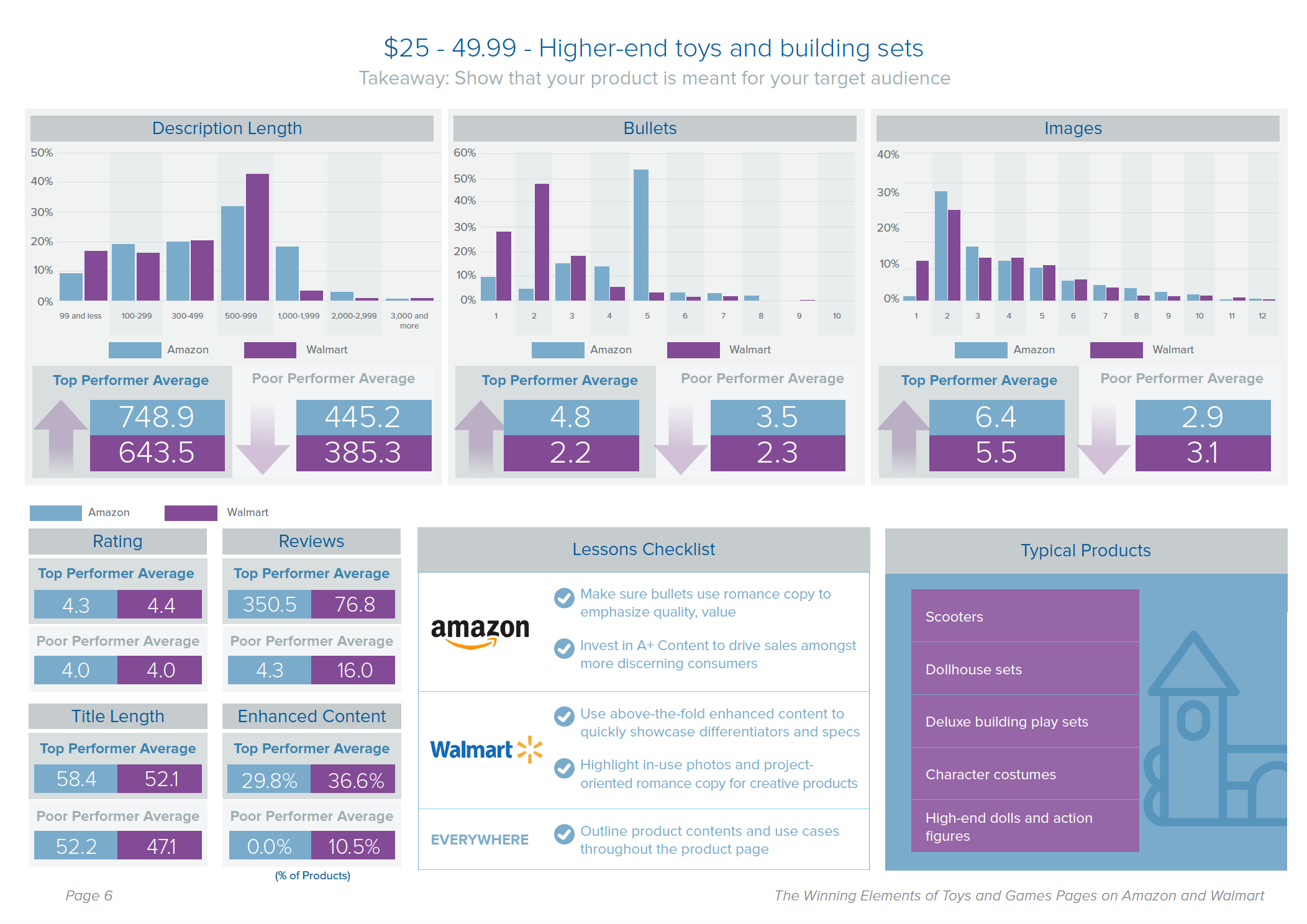

The Higher the Price Point, The More Images Matter

Across both Amazon and Walmart.com, the average number of images present on top-selling product pages goes up steadily alongside price - topping out over 7 for products costing $100 or more. This emphasizes that consumers who are open to spending more when shopping for toys and games products are looking for the kind of robust imagery that emphasizes that the product is high quality and gives them reasons to click 'buy'.

Enhanced Content Increasingly Separates High and Low Performers

Top-performing products across price points have between 4.9 and 6.2 images, on average, while poor performing brands have less than 3. Additionally, many top-selling products include one or more photos with in-image text around unique features, giving consumers easily discernible reasons to buy their brand without needing to scroll down the page.

Enhanced Content is a Critical Way to Showcase Your Brand

Across price points, top performers use A+ Content much more frequently than poor performing products. Consider outlining unique product benefits below the fold and highlighting positive attributes or your related product line, with photos.

Ultimately, your Amazon product detail page is the chance to represent the full story of every item you sell. Buyers want to understand the purpose, benefits, and why they should buy from your brand, at a glance. By understanding the tactics used by top-performing pages at every price point, you can adjust your own strategy and stand out across the digital shelf.

Written by: Andrew Waber

Andrew Waber (he/him) is a data-driven ecommerce expert and former director of insights at Salsify, where he led research initiatives to help brands optimize their digital retail strategies.

Recent Posts

How Brands Can Use Digital Product Passports To Promote Sustainable Commerce and Build Consumer Trust

7 Excellent Product Description Writing Examples

How the Pantone Color of the Year Affects Brand Strategy

Subscribe to the Below the Fold Newsletter

Standing out on the digital shelf starts with access to the latest industry content. Subscribe to Below the Fold, our monthly content newsletter, and join other commerce leaders.

.svg)